Using standard neoclassical textbook microeconomics, one can show that surplus value emerges from consuming labor power by firms even under the strict conditions of perfect competition and diminishing returns to labor.

Starting from the first-order conditions for maximizing a profit function, equilibrium in the labor market occurs where labor is paid in wages (w) the market value of its marginal product (MRP).

Based on this first-order condition, neoclassical economists commit a fallacy of composition, i.e., they assume that since THE LAST WORKER HIRED gets paid the value of her or his marginal product, THEN ALL WORKERS HIRED GET PAID THE VALUE OF THEIR MARGINAL PRODUCT TOO.

But that is NOT true according to neoclassical theory itself. Firms stop hiring at that equilibrium point. They go on hiring as long as MRP is greater than w, and stop hiring when MRP = w. So that equilibrium point tells us simply how many units of labor should be hired to maximize profit for the firm. This is just like any consumer would go on consuming units of any good or service so long as its marginal utility is greater than its price (the marginal utility of the $$$ given up to buy it). In the product market, equilibrium tells us what the equilibrium quantity bought and sold will be (given a constant price).

As a result, a consumer surplus emerges. In the case of labor markets, the consumer is the entrepreneur. The consumer surplus is hereby the surplus appropriated by the firm from consuming labor. And what do we call that otherwise? Long ago, someone called it surplus value. We can call it a “chicken”, but that won’t change what it is.

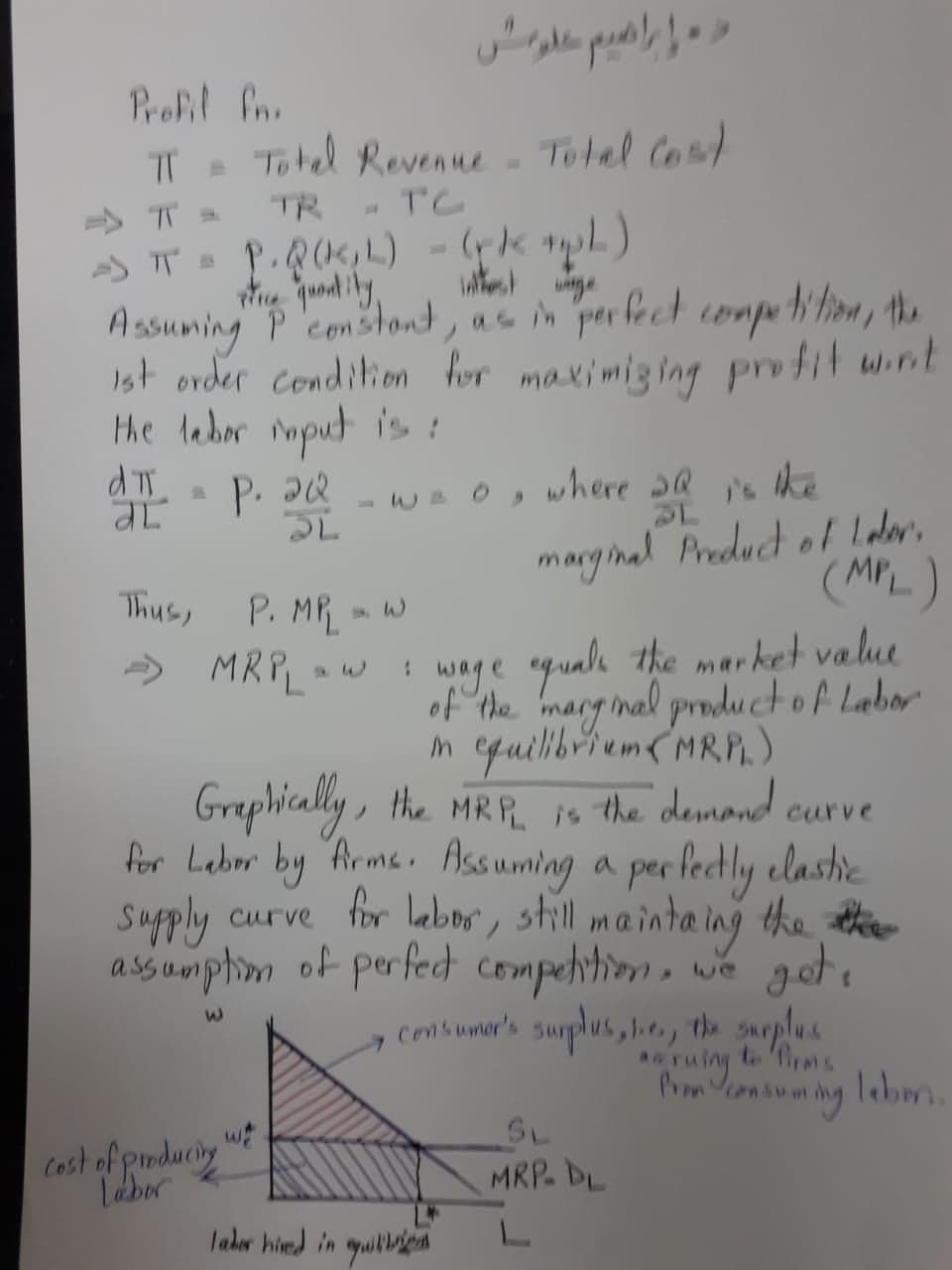

The mathematics and a graphical illustration are worked out in the attached photo.

That consumer surplus/ surplus value is the area under the demand curve for labor and above the equilibrium wage, which is also the labor supply curve here (since we are assuming perfectly competitive markets in the product and input markets) since a perfectly competitive firm envisages a labor market where it can hire all the labor it wants at the going market wage.

Just one thing: for every worker to be paid the value of her or his marginal product, there has to exist a labor market where the supply and demand curves for labor overlap snugly on top of each other, with an infinite number of equilibrium points. Otherwise, if we include an element of monopsony in the labor market, with a few large firms buying labor, or if we include an element of monopoly power in the product market, restricting production, and therefore the labor input, which would make the supply curve of labor increase, or shift to the right, for other firms, the surplus value would get much larger, so this attached illustration was worked out under the strict assumption of perfect competition, to make the point stick. A similar surplus value exists from using K of course, hence the distinction between the interest rate as a return to capital, and the profit rate (which goes to entrepreneurs and banks). But that is another story.

Ibrahim Alloush

https://www.facebook.com/photo.php?fbid=116316956898237&set=a.107329664463633&type=3&theater