Technically speaking, the capital value of a publicly-traded firm is equal to the value of its shares, i.e., the value of its market stock. For example, if company X has 1000 stocks (shares outstanding) in circulation, and each is worth $100, then the capital value of that little firm is worth $100,000 if someone wants to buy it.

However, stocks, public and private bonds, cash, bank deposits, forwards, futures, and options contracts are just examples of financial assets. They do not have intrinsic value by themselves since they merely represent a legal claim on tangible assets (physical capital which generates a stream of future income) such as real estate, plant and equipment, inventory, bullion, and deposits of raw materials in mines and what have you.

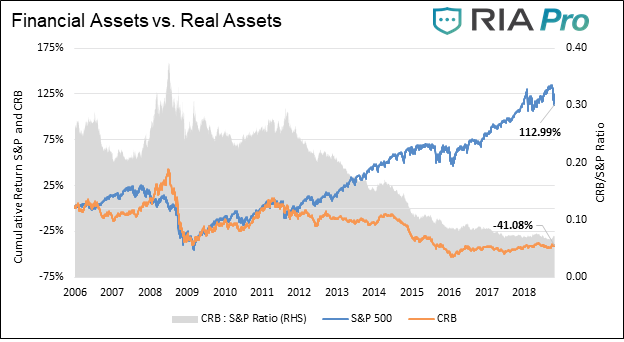

The clincher is that the market value of tangible assets is supposed to match the market value of financial assets IN THE LONG RUN. But it does not. As it happens, the market value of financial assets in recent years has been hovering several times over the market of value of the tangible assets they are supposed to stand for. This is like an overblown balloon threatening to blow up at any “sting”, so to speak.

Students of Macroeconomics should be familiar with the IS-LM model which is supposed to generate simultaneous equilibrium in the product and the money markets. The money market and the capital market are both subsections of the financial market where the value of financial assets is determined through supply and demand. Yet, monetary stimulus packages (increasing the money supply), speculation (straight poker gambling in the stock and commodities markets), and massive government aid to large banks (such as bailing out defaulting financial institutions in 2008), has elicited the largest historical divergence ever between the long-term market values of financial versus tangible assets. This is called a “price bubble”, and it’s not another type of chewing gum!

According to one study by Reuters in September 2019, U.S. household net worth, i.e., financial assets, has reached $113.5 trillion in second-quarter 2019. And according to another study by Jonathan Knowles in July 2019, tangible assets represent only 20% of the financial value of the largest 500 publicly-traded companies listed in the USA. 20%!

The attached graph shows the cataclysmic divergence between the values of financial and tangible assets in recent years. It’s like this: suppose a stock that is worth $100 yields $5 a year. Suppose speculation raises its price to $200, then $300, then $1000, etc.. not because the buyer of the said stock is expecting a rate of return that is at least equal to the interest rate s/he can earn from depositing the value of that stock in a bank, but because s/he expects a capital gain, i.e. an increase in its price or market value because another buyer is expecting the same and so will buy it for an even higher price. Eventually, that price bubble will blow up, and so will the real economy. Such was the lesson of the stock market crash in 1929 and of the housing market in 2008.

Granted, some of the difference in the market value of tangible to financial assets is due to the emergence of another type of asset, a third type, called intangible assets, such as intellectual property rights, patents, and what have you, embodying the revolutionary technological advances that have been taking place progressively over the last couple of decades. The contribution of this new third type of asset to market value needs to be researched independently. Nevertheless, this phenomenon is much older than such technological advances, and thus cannot possibly explain the whole difference between the diverging values of tangible and financial assets. It’s about speculation, and the short-term greed of financial capital undermining the real economy.

Going back to the IS-LM model, which is supposed to generate an aggregate demand (AD) curve for the whole economy, it should be said that when the whole economy hinges on the volatility of speculation, making the AD curve unstable, no wonder macroeconomic equilibrium becomes an ephemeral state. As Keynes himself puts it:

“When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.”

Given that, and this note is just for professional economists, how can the Tobin-Q Theory of Investment, which relates the rate of investment positively to the value of financial to real assets, hold any water?

Ibrahim Alloush

Real versus Financial Capital: the Fundamental Disequilibrium Destabilizing the Macroeconomy TodayTechnically…

Geplaatst door Ibrahim Alloush op Zondag 11 oktober 2020