For people living in countries torn by war, then besieged by stifling sanctions, the issue of rising prices and depreciating local currencies is a very emotional subject which impinges on the very core of their livelihood and the livelihood of their families. Yet it is precisely such dire situations which require an objective understanding of what has been going on with the economy.

Two equations which may help explain why prices rise and local currencies appreciate in countries that have gone through a devastating war, a suffocating siege, or both, are:

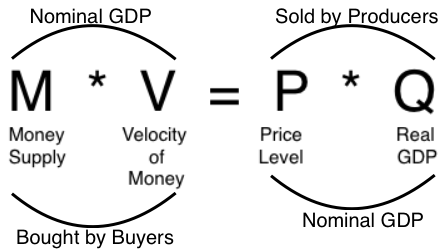

1) the quantity theory of money: MV = PQ, and

2) the theory of relative purchasing power parity (PPP) in international finance.

The roots of the quantity theory of money were said to have been formulated at least two centuries ago. It states that M (the money supply) multiplied by V (the velocity of circulation of money in the economy per year) is equal to P (the price index, or price level) multiplied by Q (the quantity of goods and services produced in the economy).

If P and Q are matrices of the prices and the quantities of all the goods and services produced in a given economy in one year, then by multiplying them we obtain GDP, i.e. Gross Domestic Product, or the value of all the goods and services produced in an economy.

For example, suppose a given island country produces only three goods: wheat, fish, and clothes. Suppose it produces 1000 tons of wheat per year, and each ton is sold for $200; 500 tons of fish, and each ton is sold for $2000; and 10000 square meters of cloth, and each square meter is sold for $7 per square meter; then the value of that island’s GDP is equal to $1,270,000 = ((1000 times 200)+ (500 times 2000) + (10000 times 7)).

Money supply (M) is all sorts of money, from cash to bank accounts. The amount of money in circulation is determined by central banks (before the age of bitcoins). Velocity is the number of times a given unit of currency is used for conducting transactions in a given time period, for example in one year. For example, if in our example above the island country has 250,000 units of currency in circulation (assume that they use US dollars), and since GDP was calculated to be 1,270,000, that means V is equal to GDP/M= 5.08, which means that each dollar circulates to buy goods and services a little over five times a year.

The quantity theory of money (MV=PQ) essentially tells us that, assuming V is constant, the price level is a function of the ratio of the money supply to the quantity of goods and services in circulation. This is because MV/Q= P. Therefore, if Q decreases, then P automatically increases, even if the money supply increases at the same rate as it used to.

So, take a country like Syria whose infrastructure has been destroyed, whose tourism industry has been decimated by terrorism, whose factories have been pillaged, whose oil and gas is being plundered by the US government, and whose fields of wheat and olive groves have been burnt down methodically, etc… then what you get is a huge DECREASE in Q, that is, in the quantity of goods and services being produced, which will automatically cause the general price level to rise, holding all other things constant, to the extent the quantity theory of money is applicable to any economy in the world.

To take a specific example, consider this: Syria used to produce before the war 385,000 barrels of oil per day. Now it produces 24,500 barrels of oil per day. It is estimated that the country needs 136,000 barrels of oil per day. So given the ban on exporting oil to Syria, what do you think will happen to the price of oil and its derivatives with such a tremendous difference between supply and demand?

Take another concrete example: Syria used to produce 4 million metric tons of wheat per year before the war. Now it produces somewhere between 1-1.5 million metric tons. It is estimated that the country needs 2.5 million metric tons. So given the ban on exporting to Syria, or extending credit to the country, what do you think will happen to the price of wheat (and bread) with such a tremendous difference between supply and demand?

It’s really a matter of physics, more than economics, even if one is to bring prophets and saints to ration whatever oil and wheat there is to distribute after the war and the siege, that is, even if we assume zero corruption and mismanagement.

The solution? Q needs to be increased. There is no other way.

But it doesn’t stop here. As it happens, there is another theory in international finance which tells us that the exchange rate between two currencies, for example, Syrian Pounds to US dollars, is affected to a certain extent by the ratio of the inflation rates in Syria and the USA. In simple terms, assume ER means exchange rate, ER1 is the exchange rate tomorrow, next month, or next year. ER0 is the exchange rate now. So, this equation says that:

ER1 = ER0 (P in Syria)/(P in the USA).

Of course, P is the same price index we used in the quantity theory of money above. It measures the overall change in the price level of a basket of goods and services. So, if we needed 50 Syrian pounds to buy one $US in the current period, and the price level increases 11 times (Ps=1100) in Syria during a given period, and the price level increases 10% during the same period in the US (Pus=110), then the new exchange rate between the Syrian Pound and the US dollar will be, according to the theory of relative purchasing power parity:

ER1 = (50) (1100/110) => ER1 = 500 Syrian Pounds per US dollar (and we’re still in 2018).

And this result will hold true even if there is zero speculation in the black market for foreign currencies in Syria. So imagine how much worse it will get if there is a deliberate effort to crash the Syrian Pound!

Solution? Increase Q, the quantity of goods and services produced. This is NOT to say that corruption, mismanagement, and profiteering in the black market are not important. They definitely are. However, assuming they were eliminated completely, the fundamental problem will not be resolved until Q is increased. Just think that such problems were much worse before the war…

For an Arabic version of this post please go to:

https://www.facebook.com/permalink.php?story_fbid=405013574234068&id=100041762855804

Ibrahim Alloush

https://www.facebook.com/photo.php?fbid=119996586530274&set=a.107329664463633&type=3&theater