This concerns mining outer space for precious minerals, like gold, silver, and platinum, as well as phosphorus, antimony, zinc, tin, lead, indium, and copper which are much needed for industrial and food production, and which are expected to be depleted on planet earth in the next 50 years (see “Earth’s natural wealth: an audit” in New Scientist).

In fact, economic concerns, namely the search for natural resources, including oil and natural gas, occupy a big part of space exploration programs worldwide, in addition to national security considerations.

This is not a hoax. Neither is it fiction. “Star Wars” is already here. And if we set aside the new competition arising around the sea routes and resources of the North Pole, as its snows melt, outer space is slowly becoming the new frontier. Japan, the USA, the EU, Russia, China, and India, have already jumped headlong into the fray since the Cold War and even more since its end.

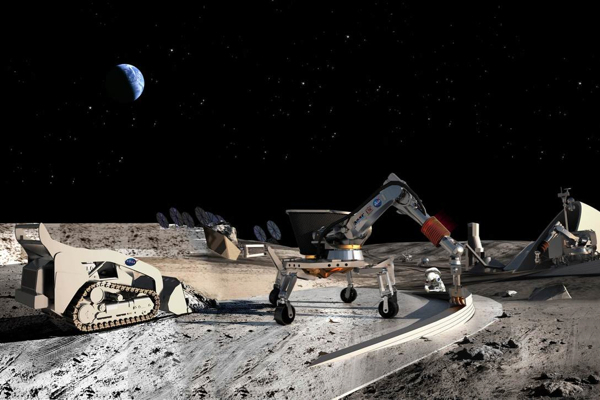

On April 6, 2020, President Trump signed an executive order allowing private citizens and companies to explore, excavate, sell, and own minerals from the Moon and asteroids, a move denounced by Russia and others as imperialism in outer space. On September 10, 2020, the Washington Post ran a story under the title: NASA seeks companies to mine the moon’s surface. The Guardian wrote: Nasa is looking for private companies to help mine the moon.

This is not about Trump, though, since President Obama had already signed the U.S. Commercial Space Launch Competitiveness Act (CSLCA, or H.R. 2262) into law in November 2015, effectively laying down the legal basis for U.S. citizens to own resources mined in space.

The issue at stake here is whether outer space (and whatever resources it contains) belongs to mankind in general or to whomever manages to lay claim to it first, that is, to a select few. Trump is saying outer space is NOT to be viewed as a “global commons” thereby paving the way for the establishment of 21st century equivalents of the East India Company.

Just to shed some more light on what’s at stake here, it should be said that there are ONE MILLION known asteroids in our solar system so far. Asteroids are very small planets, with some of them only a few meters in diameter, and some of them much larger (planetoids). As it happens many of these asteroids contain rich deposits of minerals of different types. Comets, on the other hand, are also very small planets, but they are made mainly of ice, dust, and gas. This doesn’t make them useless, however, since their ice could theoretically be separated, using solar energy, into hydrogen and oxygen, which can then be used to energize space stations, ships, and exploration sites in outer space.

The obstacle to space mining so far is the prohibitive cost of space travel. But space travel technology is advancing so rapidly this obstacle might be overcome maybe in a couple of decades.

The other obstacle is economic feasibility, namely, if abundant natural resources in outer space are brought to earth, that may just cause their market prices to plummet. Solution: create private sector monopolies, like the East India Company, to control the supply of outer space resources, that is, create scarcity out of abundance, and let a select few enjoy it!

Ibrahim Alloush

https://www.facebook.com/ibrahim.alloush.7315/posts/110883737441559